Getting your sales forecast right…for agencies & consultancies

Everything has an impact

Losing a customer, underestimating a scope of work, delivery issues or a key member of staff resigning at short notice makes balancing the profitability and cash flow of agencies especially tough.

What makes agency finances so challenging?

There are several characteristics of agencies or consultancies that make them particularly tricky to manage:

- Broad service offering and a high dependency on contracted staff. Marketing agencies often cover a broad range of services – from Campaign work, web and app develop, though to SEO, Advertising, Content, Events, Analytics & Branding, each requiring specialised skills. As a result, as much as 50% of the workforce might be short term contractors at any one time. This can often make margins very tight.

- Deals are often fixed price and short term contracts. Deals tend to be fixed priced and tied to a pre-agreed scope of work, with customers constantly pushing scope boundaries. Whilst most agencies push for retainers, it’s rare for 50% of income to be retained or multi-year.

- Customers invoiced in milestones. Work is often delivered in sequence over several months, with new phases contingent on the completion of another. Customer billing milestones are often ad hoc and tied to project delivery milestones.

Why is a revenue forecast important?

Having an up-to-date and accurate revenue forecast based on meaningful revenue recognition is crucial.

It will give you a much better holistic view of your business performance and make resource planning substantially easier. Yet, nearly every agency out there, and there are a LOT, still managing their pipeline in a spreadsheet.

Sales Bookings vs. Accounting Revenue – find out more

A sales bookings are a list of orders/deals/opportunities a business hopes to sell.

Accounting Revenue is how these orders are recognised as income, on a monthly basis, through time – also known as Revenue Recognition. Revenue recognition tells someone the period over which income is earned from a customer, not just when it is invoiced, paid or sold to the customer.

Why might you want to introduce a CRM?

It’s generally clear to businesses why a spreadsheet is not an ideal solution for managing a sales pipeline across teams, but what are the main reasons you might want to introduce a CRM?

- Increased collaboration Automatically stored communication allows you to view emails, calendar, and phone call details in one easily accessible place. Sales, marketing, and customer service teams can share valuable information about clients

- Greater staff satisfaction. The more knowledge your employees have the more empowered and engaged they are.

- Efficiency. You now have a central client and prospect database that everyone can access rather than everyone keeping a separate spreadsheet or contact database on their computer

- Better client relationships. The more you know, and remember, about clients (or customers) the more your clients know you care about them. This enables you to forge a much stronger connection and a deeper relationship with your clients.

- Improved analytical data and reporting. CRM systems store consistent information in one place which leads to improved analysing of the data as a whole.

Why are CRMs alone not great for forecasting?

Whilst there are many clear benefits to using a CRM, there are several common barriers to them being effective for forecasting revenue.

- CRMs forecast Sales (bookings) NOT (recognisable) Revenue. CRMs think it terms of deals/bookings closing at a particular point in time. Yet service organisations think about projects and retainers being delivered and serviced over multiple months. This is crucial for them to understand true profitability and manage resources effectively.

- CRM data is too fluid, and commercials change. When you’re trying to keep a tight grip on your sales pipeline, the last thing you want is for someone to make a change to a deal closed 3 months ago without you knowing. You need to see any true-ups in the latest period. Yet there is no concept of restrict historic data changes in a CRM.

- Too hard to reconcile against actuals. The only way you’ll ever really know if you can trust your CRM data is to reconcile it against monthly actuals (in your accounting system). But this is time consuming and often complex due to different naming convention’s between systems.

- Deals are paid in milestones. CRMs effectively assume all deals are paid upfront. This almost never happens in reality – often deals are paid in milestone payments and partially in arrears.

How can QuarterOne help?

We built QuarterOne to help businesses unlock value from their CRM data and other tooling. In particular we focus on bridging the gap between CRM data and meaningful revenue forecasts– ultimately how businesses recognise income and invoice their customers.

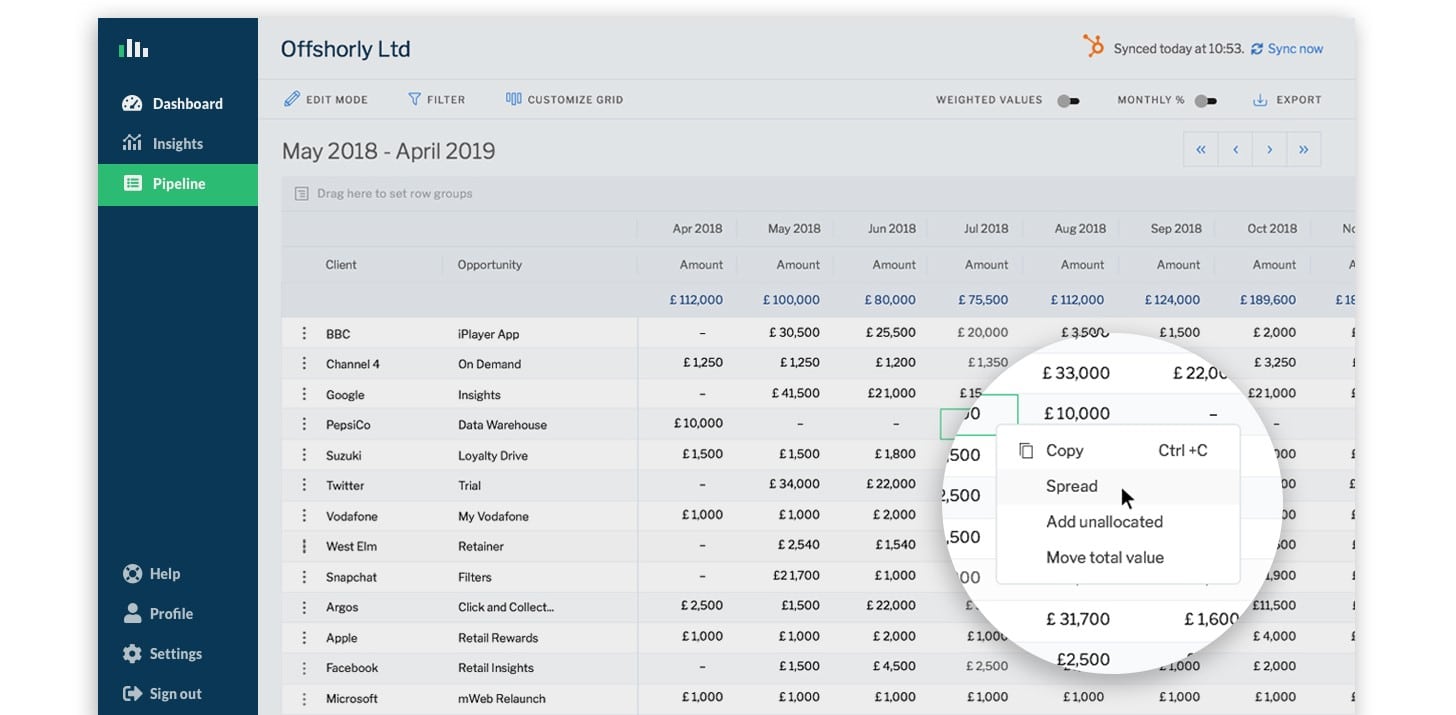

Spread deals values over multiple months

Generate meaningful revenue forecasts by spreading deal values over multiple months or into monthly milestones.

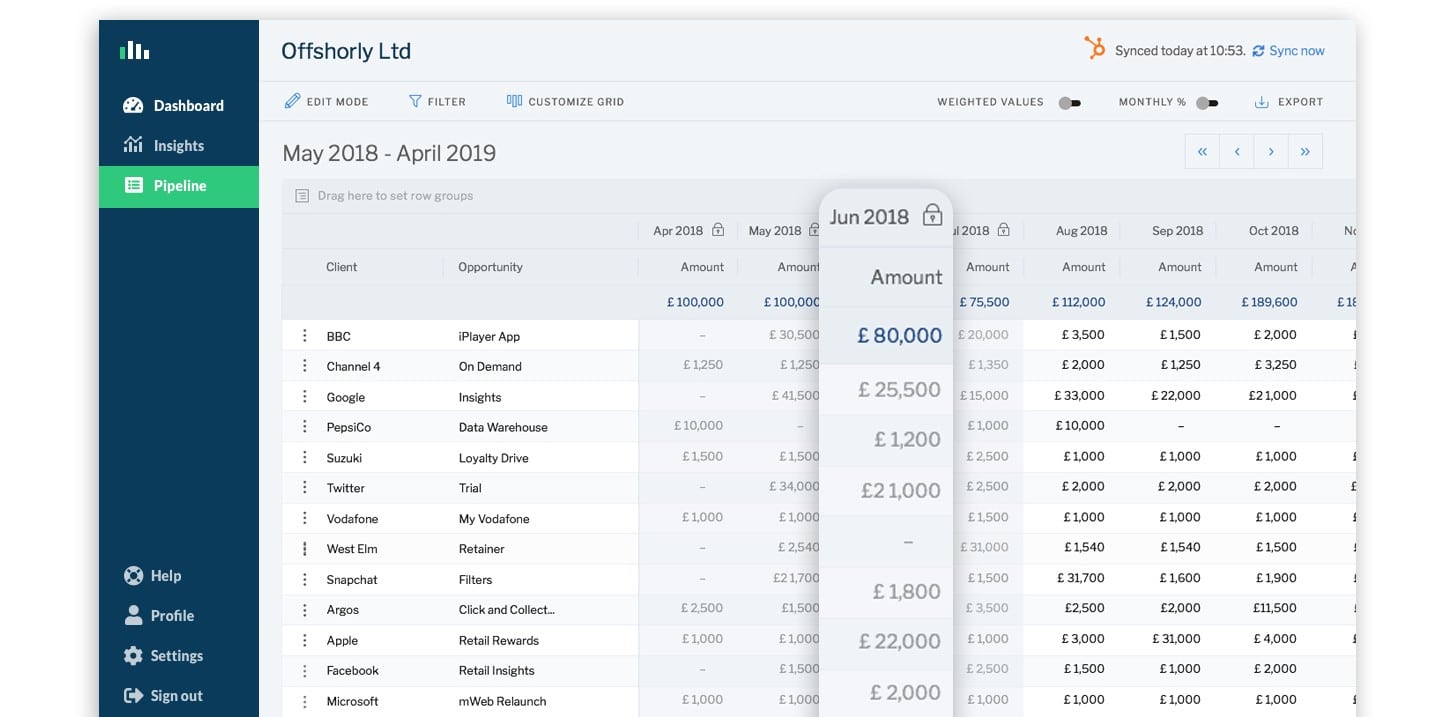

Lock down reported periods

Avoid changes in the CRM retrospectively changing your forecasts or reported periods. This also makes it far easier to reconcile monthly actuals to forecasts.

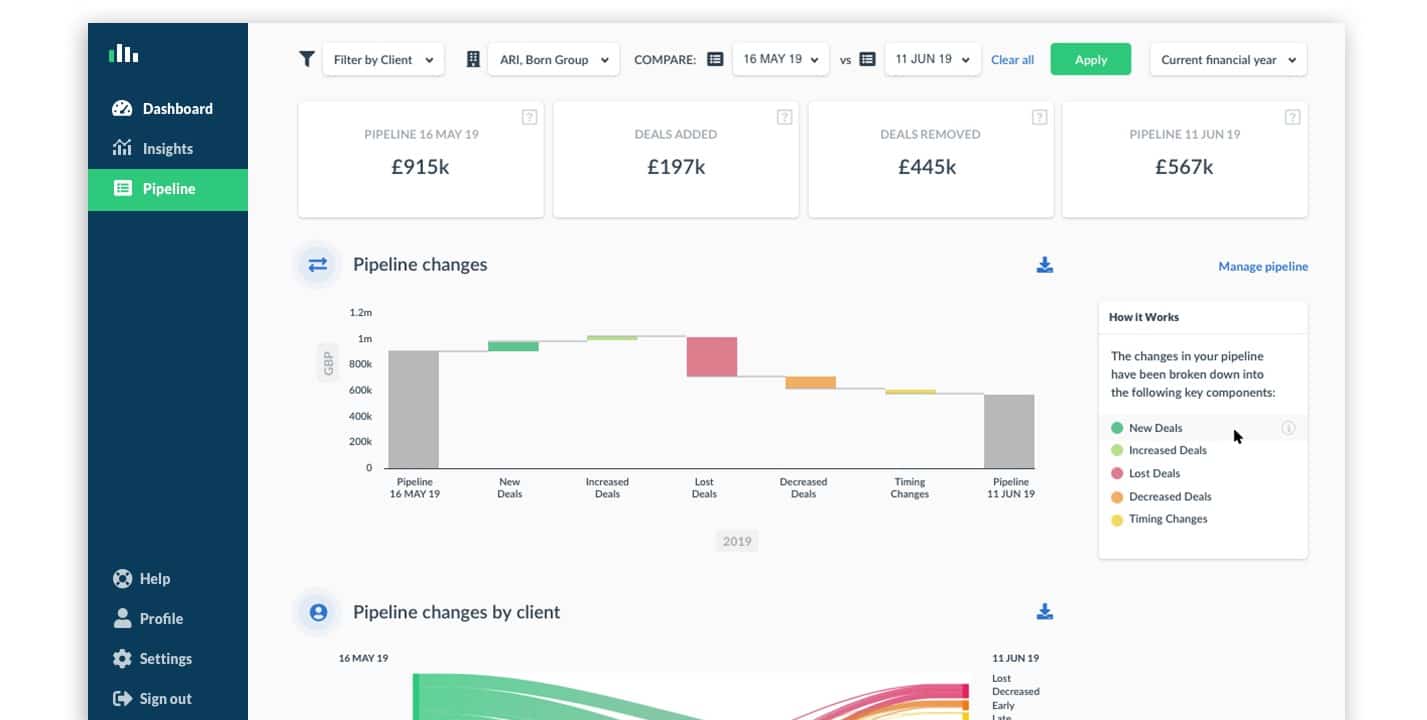

Compare your pipeline with previous dates

Immediately understand if your business is making progress.

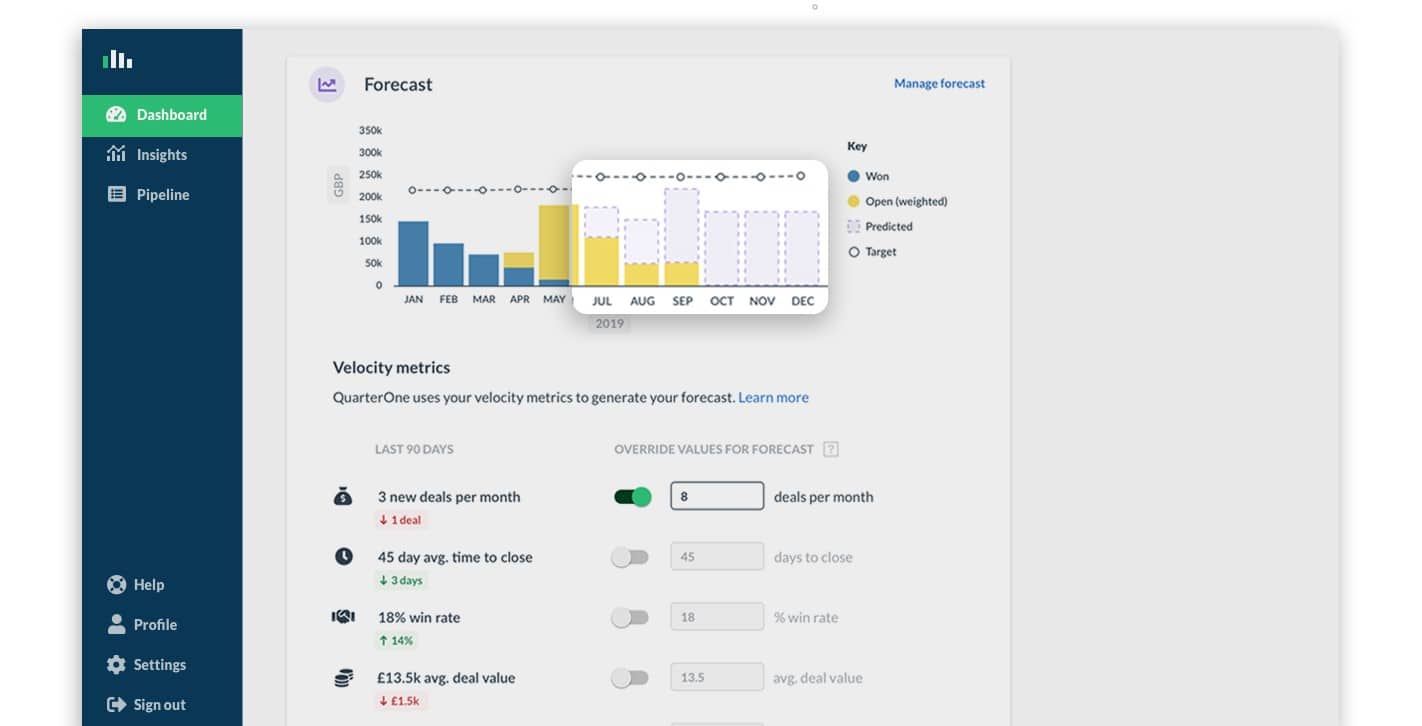

Instant New Business Predictions

Predict how quickly your existing pipeline will grow based on the velocity of your sales team.

How do I get started?

Watch our webinar on ‘Getting your sales forecast right’ – we take a deeper look into the points raised in this article. You can access the recording here.

Check out our blog on Using QuarterOne & your CRM for better sales forecasting to get started today.